By cuterose

Royal Bank of Scotland launches new £150 switch and stay offer rewarding customer loyalty

Royal Bank of Scotland (RBS) is the latest big name on the high street to offer cash incentives to motivate new and existing customers to stay with them, fending off fierce competition from HSBC, Nationwide, Santander, LLoyds and Virgin Money.

RBS is offering £150 to new and existing customers who switch and stay by 5pm on November 18, 2021.

New to Royal Bank customers can apply to switch to a Select or Reward account along with existing customers who can also apply to switch to Reward Silver, Reward Platinum or Reward Black. The Reward account gives customers £4 per month for two Direct Debits and an additional £1 for logging onto online banking, but it also carries a monthly fee of £2.

Customers can also benefit from regular retailer cashback offers.

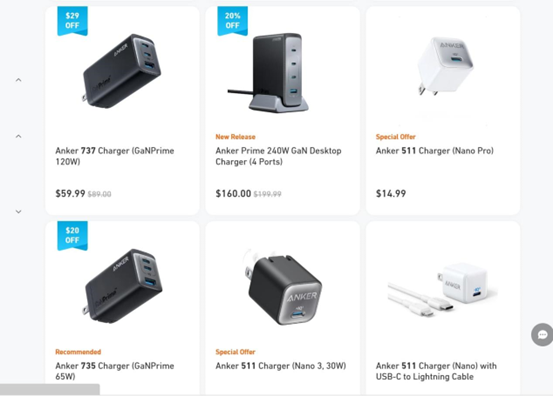

Royal Bank’s Select account has no monthly fee and has the benefit of GetCash which enables customers to withdraw money from a cash machine without their bank card using a passcode sent to their mobile phone.

The Select account received five stars, the highest rating possible from Defaqto.

Commenting on the new offer, Allan Hardie, Royal Bank, said: “We are welcoming new customers with our latest switcher offer which really encourages taking advantage of the account and also discovering further benefits such as our award-winning mobile app and our Digital Regular Saver account paying 3% interest.”

Switching bank accounts is simple and to get the offer, must be done through the Current Account Switch Service.

Payments, such as Direct Debits and Standing Orders, along with incoming payments including salary and benefits payments are automatically transferred to the newly opened account within seven days.

An account can be opened online at www.rbs.co.uk or by downloading the Royal Bank mobile app.

Anyone switching to Royal Bank will also be able to take advantage of their new Digital Regular Saver account paying a market leading 3% which is designed to help customers with little or no savings develop a savings habit and build financial capability.

Top Money Stories Today

Switchers are required to use the Current Account Switch Service, close their existing account and transfer their main current account to RBS November 28, 2021.

Customers must pay in £1,500 to the account and log into online or mobile banking through the RBS mobile app before December 30, 2021.

After these conditions are met, £100 will be credited to the account by January 28, 2022.

An additional credit of £50 will be applied to the account if 10 debit or credit transaction are made per calendar month between January 1, 2022 to September 30, 2022.

Customers must be 18 or over and not have received a switcher offer from the NatWest Group for opening a new current account and switching after October 2017.

Get the latest money-saving and benefits news sent straight to your inbox. Sign up to our weekly Money newsletterhere.