By cuterose

ARK Invest's Big Ideas 2022: The 14 transformative technologies to watch this year

ARK Invest solely invests in disruptive innovations. ARK's thematic investment strategies span market capitalizations, sectors, and geographies to focus on public companies that we expect to be the leaders, enablers, and beneficiaries of disruptive innovation. ARK's strategies aim to deliver long-term growth with low correlation to traditional investment strategies.

ARK Invest defines "disruptive innovation" as the introduction of a technologically enabled new product or service that potentially changes the way the world works. ARK focuses solely on offering investment solutions to capture disruptive innovation in the public equity markets.

ARK released their annual BIG IDEAS 2022 research report centered around the belief that fiveinnovation platforms are evolving and converging atthe same time: Artificial Intelligence, Robotics, EnergyStorage, DNA Sequencing, and Blockchain Technology. ARK has identified 14 transformative technologies that areapproaching tipping points as costs drop, unleashingdemand across sectors and geographies, and spawningmore innovation.

Here are the 14 transformative technologies that are approaching tipping points in the ARK 2022 Big Ideas Report:

- Artificial Intelligence

- Digital Consumer

- Digital Wallets

- Public Blockchains

- Bitcoin

- Ethereum and DeFi

- Web3

- Gene Editing

- Multi-Omics

- Electric Vehicles

- Autonomous Ride-Hail

- Autonomous Logistics

- Printing and Robotics

- Orbital Aerospace

ARK research forecasts that disruptive innovation technologies will grow from a $14 trillion market in 2020 to a $210 trillion market by 2030. ARK research forecast of market capitalizations by 2030:

Convergence across technologies could amplify their potential. For example, the convergence of robotics, battery technologies,and artificial intelligence is likely to collapse thecost structure of transportation, impacting theeconomics of auto, rail, and airline activities. Let us take a deeper look at 5 of these critically important transformative technologies in the ARK 2022 report: AI, Digital Consumer, Digital Wallets, Web3, and Electric Vehicles.

Artificial Intelligence (AI)

Per ARK, Artificial Intelligence (AI) training costs appear to be declining at more than twice the rateof Moore's Law1 as performance is increasing significantly.By automating the tasks of knowledge workers, AI should boost productivity and lower unitlabor costs significantly. An example of cost reduction: Given 240 trillion synapses, the cost to train aneural network equivalent in size to the humanbrain in 2021 would have been $2.5 billion and islikely to drop 60% at an annual rate to $600,000by 2030.

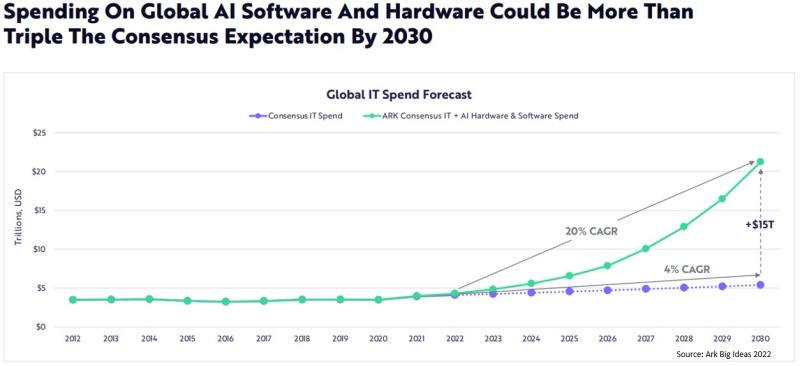

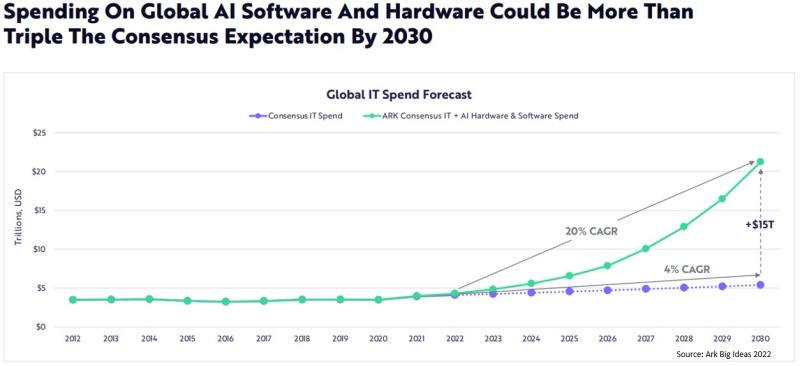

ARK suggests that the market capitalization of AI hardwareand software companies could scale at a roughly 50% annualized rate, increasing from $2.5trillion in 2021 to $87 trillion by 2030. Based on Write's Law, ARK forecasts that convergence of hardware and software could drive down AI training costs by 60% at an annual rate by 2030.

ARK suggests that AI could automate the tasks of knowledge workers and boost productivity. ARK's forecast is that by 2030, AI will increase the output of knowledge workers by 140%.

By 2030, artificial intelligence is likely to boost the output of global knowledge workers by 9% at an annual rate, from $41 trillionin expected human labor output to roughly $97 trillion in AI + human output.

ARK estimates that organizationswill increase spending on enterprisesoftware by 42% at an annual rate of$14 trillion a year. If automation boosts productivityby 140%, AI software could increasethe output of global knowledgeworkers at an annual rate of 9% to$97 trillion in 2030. ARK estimates that SaaS companies spend 50%+ of their cost of goods sold (COGS) on infrastructure hosting costs.As demand for AI software grows, the demand for hardware could rise accordingly.

Spending on global AI software and hardware could reach over $20 Trillion by 2030. AI could scale from almost $2.5T to $87T in enterprise value by 2030. By 2030, AI software companies couldproduce $14 trillion in annual revenuecollectively. The resulting $4 trillion in freecash flow could create over $80 trillion inenterprise value, up from $2.3 trillion in 2021,generating returns of 48% at a compound annual rate during the next nine years. By 2030, AI hardware companies couldproduce $1.7 trillion in annual revenuecollectively. The resulting $350 billion in freecash flow could create $7 trillion in enterprisevalue, generating returns of 57% at acompound annual rate during thenext nine years.

Digital Consumers

According to ARK: the new digitally native consumer is spending an increasing amount of time socializing,playing, and purchasing online. As digital takes share in our daily lives, we believe themarket — as measured by online entertainment spend, advertising spend, and platforme-commerce fees — is likely to grow at an 18% compound annual rate during the next fiveyears, from $1.8 trillion today to $4.1 trillion in 2026.

ARK estimates that on average in 2021, internet users spent38% of their free time online and 62% offline. By 2030, we expect these averages to flip, with users spending 52% of their free timeonline and 48% offline. Social platforms are scaling like never before. The accelerating adoption of online platforms gives businesses and individuals the ability to reach global audiences.Today, 6 platforms have more than 1 billion monthly active users, and 29 platforms have at least 100 million monthly active users.

Digital channels are how businesses are reaching their customers. By the end of 2021, global digitaladvertising totaled roughly $440 billion, or 62% of the total advertising market. ARK forecasts the global digital advertising market willgrow at an 11% compound annual rate over the next eight years, surpassing $1 trillion in expenditures by the end of 2029.

Social commerce is the next wave in online shopping. When implemented correctly, social commerce combines the convenience of online shopping with the network effects of socialmedia. ARK expects social commerce gross merchandise value (GMV) to grow at a compound annual rate of 41% over the next five years to $3.7 trillion, more than doubling it from less than 10% of total e-commerce today to 22% in 2026. ARK estimates that the revenue associated with discretionary online time will increase from $1.8 trillion today to $4.1 trillion by 2026.

Digital Wallets

Today, digital wallets like Venmo, Cash App, and others around the globe are penetratingtraditional financial services, including brokerage and lending, thanks to superior user experiences and much lower costs of acquisition. In ARK's view, digital wallets could scale at an annual rate of 69% in the US, from more than$400 billion in market capitalization to $5.7 trillion, and 78% globally, from $1.1 to $20 trillion,during the next five years.

Digital wallets are the number one payment method offline and online. Dominating e-commerce payments since 2017, digital wallets surpassed cash last year in point-of-sale (POS) payments, likely inresponse to the COVID-19 pandemic. The number one digital wallet users have surpassed the number of deposit account holders at one of the largest US banks. Based on publicly available data, Square's Cash App and PayPal's Venmo have amassed 74 million and 82 million annual active users inthe past 8 and 11 years, respectively. J.P. Morgan hit 60 million deposit account holders after five acquisitions in more than 30 years

Differentiated customer acquisition strategies result in lower customer acquisition costs. ARK shows a customer acquisition cost variance from $2,500 per customer to $1 (Nubank). ARK estimates that each digital wallet user in the US could be worth $22,500 at maturity. The US digital wallet opportunity could scale 69% at an annual rate of more than $400 billion in 2021 to $5.7 trillion by 2026. The global digital wallet opportunity could scale to 78% at an annual rate from $1.1 trillion to $20 trillion in 2026.

Web3 - An Internet Revolution

Now that consumers are spending more time and resources online, the importance of digitalassets is likely to increase considerably as consumer spending shifts to virtual worlds.A global framework like non-fungible tokens (NFTs) provides a stable way of taking theownership and control of digital assets away from corporations, to the benefit of individuals. By 2030, ARK expects Web3 to depress annual offline consumption by $7.3 trillion,boosting direct online expenditures at an annual rate of 28%, from $1.4 trillion todayto $12.5 trillion per year.

Also: What is Web3? Everything you need to know about the decentralized future of the internet

Public blockchains enable the ownership of digital assets. Non-fungible tokens (NFTs) serve as smart contracts that verify the ownership of digital assets on public blockchains. They usurp thepower of centralized platforms to house, control, and verify assets. In 2021, NFTs generated $21 billion in sales as the number of monthlyunique buyers soared nearly eight-fold to more than 700,000.

Public blockchain infrastructure serves as the backbone for new forms of economic coordination: it minimizes the need to trust centralizedinstitutions. The decentralized, open, and permissionless characteristics of public blockchains lower the cost of coordination, among otheradvantages.

Currently, collectibles and digital art accountfor more than 75% of NFT sales on Ethereum. Based on the evolution of the video gamingmarket, NFT demand for blockchain-basedgames and virtual worlds could exceed that fordigital collectibles and art, especially ascollectibles and art begin to exhibit moreutility in various games during the next five toten years. ARK believes NFTs will blur the lines between consumption and investment.

ARK believes that if Web3 proliferates, the monetization rate of online spending should approach that of offline spending by 2030. ARK research suggests that the monetization of time spent online will grow at a compound annual rate of 19% with Web3 but only 8% without Web3 during the next ten years. Web3 annual online spending could reach $12.5 trillion in the next decade.

Electric Vehicles

As their range increases, the prices of electric vehicles (EVs) are declining,overcoming the most significant barriers to customer adoption. Based on Wright's Law, ARK forecasts that EV sales will increase roughly eightfold,or a 53% annual rate, from 4.8 million in 2021 to 40 million units in 2026. According to ARK,the biggest downside risk to our forecast is whether traditional automakers will beable to transition successfully to electric autonomous vehicles.

Electric vehicles costs could rival gas-powered options by 2023. The total cost of ownership for a like-for-like EV dropped below that of a Toyota Camry in 2019.1 EV production costs and sticker pricesare likely to drop below those of gas-powered vehicles in the next one to two years and undercut them by 25-35% in 2025. ARK's research shows that the median performance of EVs in 2021 is approaching Tesla's performance in 2018.Both should continue to improve.

If traditional automakers navigate the shift from gas-powered vehicles successfully, EV sales could scale 8-fold from 4.8 million to 40 million during the next five years.

The ARK Big Ideas Report 2022 is comprehensive research covering five innovation platforms (Artificial Intelligence, Robotics, Energy Storage, DNA Sequencing, and Blockchain Technology) and 14 transformative technologies that are approaching tipping points. I highly recommend that you take the time to review this important research.